Financial stability becomes increasingly important as we grow old, especially during retirement. Financial challenges like limited income resources, limited savings, rising healthcare costs, and unforeseen expenses are overwhelming for a majority of seniors. Making ends meet under such crushing challenges is extremely difficult. However, there is a precious financial product that offers a lifeline for our respectable seniors to make ends meet – the Home Equity Conversion Mortgage (HECM).

Many doubters perceive it impossible and make us wonder “HECM could help seniors make ends meet?” The answer is “yes.” In fact, a “big yes” because HECM can help seniors make ends meet. In this blog post, we will explore how HECM ensures seniors a secure financial future, independence, and a comfortable retirement.

Understanding HECM

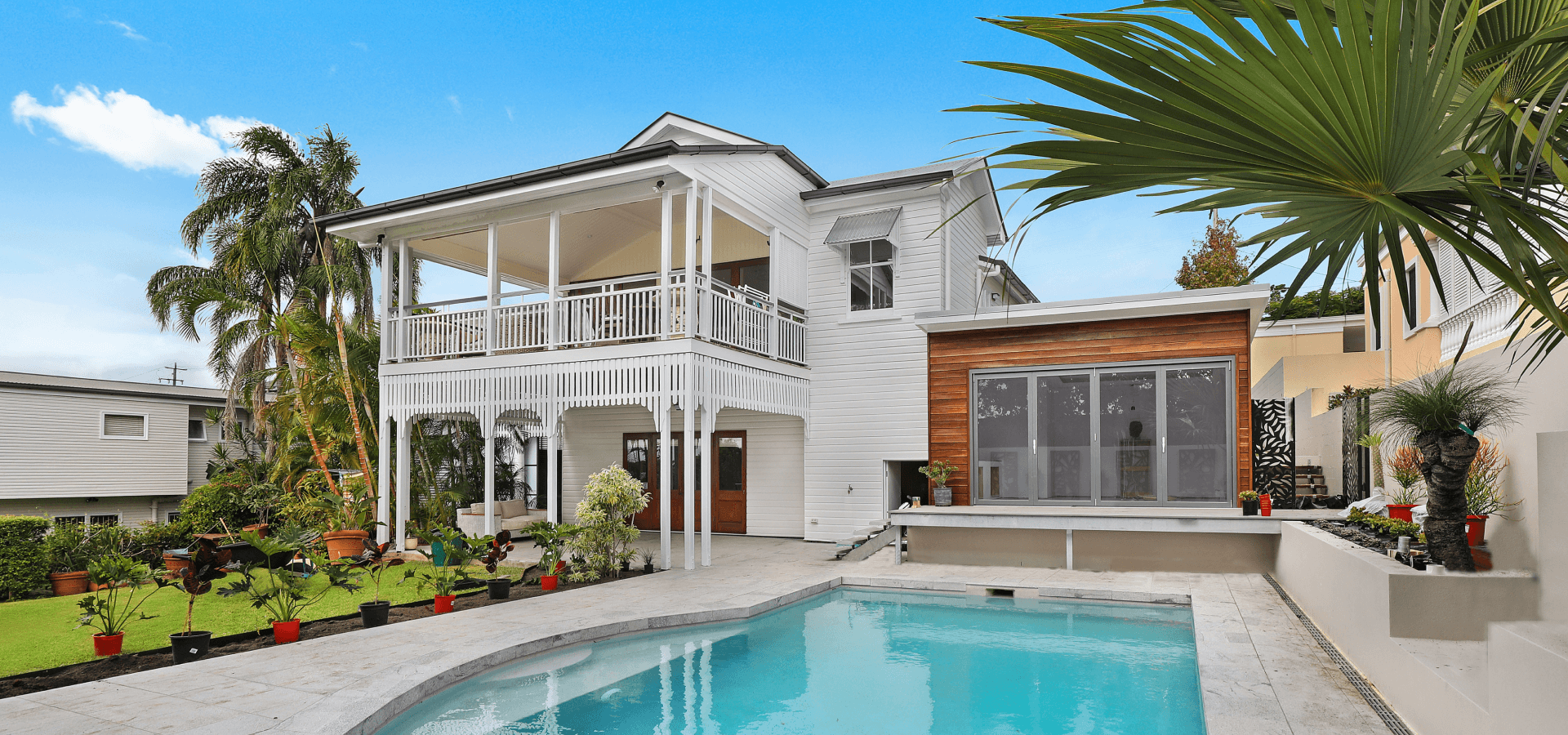

As you already know, a Home Equity Conversion Mortgage (HECM), commonly known as a reverse mortgage, is a federally-insured loan program. It is a financial product that was designed specifically for seniors aged 62 and older. It is unlike a traditional mortgage, where homeowners make monthly payments to their lenders. A HECM allows homeowners to convert a portion of their home equity into tax-free cash. So, this is a unique financial product that enables seniors to tap into their home’s value without selling or moving out.

How does HECM help seniors make ends meet?

The following are the solid arguments that prove doubters wrong and establish the fact that HECM can help seniors make ends meet.

Supplementing retirement income

HECM provides a steady stream of income for seniors during retirement and that is one of the primary ways it helps seniors make ends meet. Homeowners using this financial service can receive funds through various methods, including a lump sum, monthly payments, or a line of credit. So, HECM offers this additional income that can supplement existing retirement savings and cover essential expenses such as healthcare and home maintenance. Thus, HECM enables seniors to maintain their desired quality of life by supplementing retirement income.

Flexibility and control

HECM is also a unique financial product in the sense that it offers seniors flexibility and control over their financial decisions. As you know, HECM borrowers have no obligation to repay the loan until they move out of the home or pass away. In other words, homeowners can remain in their homes without fear of foreclosure as long as they continue to meet basic loan requirements. Additionally, seniors have also the freedom to choose how they receive the funds, based on their individual needs. They can get it as a lump sum to cover immediate expenses or a line of credit to access as needed. These are the benefits that make HECM a true helping hand of a friend for seniors.

Preserving homeownership

There is a common misconception about reverse mortgages and that homeowners transfer ownership of the home to the lenders. Contrarily, HECM borrowers retain full ownership of their homes. This means seniors continue to benefit from any appreciation of the home’s value. Moreover, the fact that seniors continue to be responsible for property taxes, insurance, and maintenance, to ensure that their homes remain assets for their families and beneficiaries also proves that seniors don’t transfer ownership to lenders.

Counseling and safeguards

There is an additional layer of protection to ensure that seniors are aware of the financial commitment they are undertaking – HUD-approved counseling. It refers to counseling sessions to educate seniors about the benefits and risks associated with reverse mortgages, helping them understand the loan terms, obligations, and alternatives. The HECM programs require borrowers to participate in HUD-approved counseling to protect seniors and ensure they make informed decisions.

The wrap-up

Making ends meet during retirement becomes significantly challenging for a majority of seniors. However, the Home Equity Conversion Mortgage (HECM) is a useful financial planning tool for esteemed seniors. It offers a viable solution for seniors to capitalize on their home equity, elevate their financial stability, and enjoy a more comfortable retirement. The way HECM offers flexibility, control, and the ability to supplement retirement income to seniors is highly commendable. So, “HECM could help seniors make ends meet?” Yes, HECM not only empowers seniors to meet their financial needs but also preserves their homeownership. Therefore, if you or a loved one are looking for ways to secure your financial future, consider discovering the potential benefits of a HECM and consult with a reputable lender to make an informed decision.